The repeal of the Professional and Amateur Sports Protection Act (PASPA) in May 2018 marked a seismic shift for the US gambling landscape, unleashing a torrent of legalized sports betting across the nation. What began as a trickle in states like New Jersey and Nevada has ballooned into a multi-billion-dollar juggernaut, dominated by online platforms. Today, with nearly 40 states offering legal sports wagering, the Total Addressable Market (TAM) for online sports betting (OSB) is fueled by mobile first users, personalized and AI driven data analytics, and shifting consumer habits.

But a new contender is emerging: prediction markets—platforms like Polymarket and Kalshi that let users bet on everything from election outcomes to sports scores via binary contracts. While their volumes look eye-popping, a closer look reveals key differences in metrics—handle versus volume—that can inflate perceptions of scale. In this deep dive, we chart the historical actuals since 2018, project TAM to 2035, dissect operator revenues and margins, and compare OSB to prediction markets.

Post-PASPA OSB Boom

Since PASPA’s fall, US sports betting has evolved from niche retail operations to a digital-first ecosystem. Online betting now accounts for over 90% of total handle (the total amount wagered), with mobile apps driving accessibility.

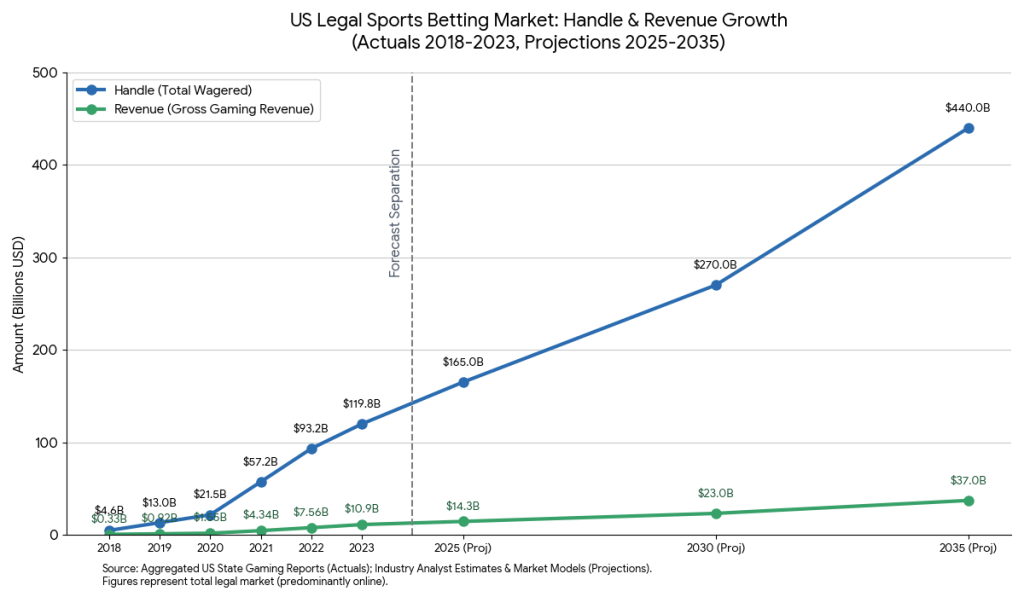

Drawing from aggregated state data via sources like SportsHandle and the American Gaming Association, the table below outlines the year-by-year breakdown of total sports betting handle and revenue.

| Year | Handle ($B) | Revenue ($B) | Hold % | Key Notes |

| 2018 | 4.6 | 0.33 | 7.2% | Launch year; NJ and NV dominate retail/online mix. |

| 2019 | 13.1 | 0.92 | 7.0% | Expansion to 7 states; online ramps up. |

| 2020 | 21.5 | 1.55 | 7.2% | COVID-19 boosts online adoption; 18 states active. |

| 2021 | 57.8 | 4.34 | 7.5% | 30+ states launch. |

| 2022 | 93.8 | 7.56 | 8.1% | DraftKings/FanDuel capture ~70% market share. |

| 2023 | 121.1 | 10.81 | 8.9% | Record year; online >95% of handle. |

| 2024 | 149.2 | 13.0 | 8.7% | 38 states + DC; NFL drives massive quarterly peaks. |

| 2025* | 165.0 | 14.3 | 8.7% | Projected full-year based on 10-month trends. |

OSB industry hold percentage—operators’ gross profit margin after payouts—has trended upward from ~7% to 8.7%, reflecting sharper odds-setting, improved customer risk management and personalized profiling alongside adjustments to promotional spending including shifts toward better unit economics of profit boost tokens tailored to multi leg and higher odds/lower probability parlay bets.

Projections: TAM Scaling to $37B by 2035

Looking ahead, the OSB TAM is poised for sustained growth at a 10% CAGR. This growth is driven by the potential unlocking of massive markets like California and Texas, international league partnerships, and deeper cross brand integrations of betting directly into media and discretionary consumer spend apps (e.g., DKNG <> ESPN advertising deal post ESPN shuttering and FanDuel bet integration and stats via Amazon Prime NBA).

| Year | Projected Handle ($B) | Projected Revenue ($B) | Growth Drivers |

| 2025 | 165.0 | 14.3 | Mobile penetration hits 85%; 40 states active. |

| 2030 | 270.0 | 23.0 | AI personalization; deeper partnership & tech integration. |

| 2035 | 440.0 | 37.0 | Full scale national roll out incl. CA and TX |

These estimates assume hold stability at roughly 8.5%. However, total TAM could swell further if hold rates edge toward 9-10% through better risk management and higher-margin product mixes like Same Game Parlays.

Prediction Markets: Volume Hype Meets Reality

Prediction markets represent a TAM wildcard, blending finance and betting. Platforms trade “yes/no” shares on outcomes, with volumes exploding post-2024 elections. However, comparing Prediction Market Volume directly to Sportsbook Handle is misleading.

The “Volume” Illusion:

- Sportsbook Handle: Counts only the bettor’s risked amount (one-sided). If you bet $100, the handle is $100.

- Prediction Market Volume: Often tallies both sides of every trade (buyer’s and seller’s notional) plus intra-trade flips. This results in double- or triple-counting of economic activity compared to sportsbooks.

While prediction market volume figures ($1 Trillion at maturity) dwarf OSB handle, however, operating on significantly thinner margins (~1-2% fees vs. OSB’s ~8.7% hold) make comparison and the appeal of segments of customers who will switch away from traditional OSB features in cross over an important core of the projected TAM value debate.

OSB vs. Prediction Markets: Head-to-Head

- Handle vs. Volume Scale: OSB’s $165B 2025 handle crushes the prediction market’s adjusted handle of $22B. However, unadjusted volumes make prediction markets appear 2-3x larger than they effectively are in risk terms.

- Revenue & Margins: OSB’s $14.3B revenue dwarfs predictions’ $0.8B. Sportsbooks profit from the “vig” built into odds, while prediction markets rely on small transaction fees, requiring massive volume to achieve comparable revenue.

- Growth Trajectory: Both sectors have hit escape velocity. OSB benefits from regulated stability, while prediction markets face regulatory hurdles (e.g., CFTC oversight) but offer a broader range of “events” (politics, economics, weather).

The Road Ahead: Convergence or Competition?

By 2035, the combined TAM of these sectors could top $57B in annual revenue. Prediction markets are likely to carve out a massive niche in non-sports events, potentially reaching $20B in revenue. For OSB operators, the ultimate play being weighed and taken up is integration and proprietary products —DraftKings or FanDuel offering prediction contracts alongside traditional sports bets. As the shadow of PASPA fades into history, one thing is clear: the business of betting on the future has never been more lucrative.

Prediction Markets: Volume, Revenue & Margin Forecast (2023-2035)

| Year | Volume ($B) | Est. Revenue ($B) | Hold % (Est.) |

| 2025 | 44.0 | 0.79 | 1.8% |

| 2030 | 250.0 | 3.50 | 1.4% |

| 2035 | 1,000.0 | 10.00 | 1.0% |

Leave a comment