The landscape of high-stakes wagering in the United States is approaching a massive shift on January 1, 2026. Buried within the One Big Beautiful Bill Act (OBBBA) is a provision that fundamentally alters the “math” of sports betting, while notably leaving the burgeoning Prediction Markets vertical untouched.

For VIP bettors and operators, this creates a stark divergence in tax efficiency and competitive strategy.

Historically, the IRS allowed gamblers to deduct losses up to the extent of their winnings (IRC Section 165(d)). If you won $1M and lost $1M, your taxable liability was zero.

Under the OBBBA, this 100% deduction is reduced to 90%. For the casual bettor, this is a nuisance; for a VIP bettor or professional moving millions in volume, it is a catastrophic “phantom income” tax.

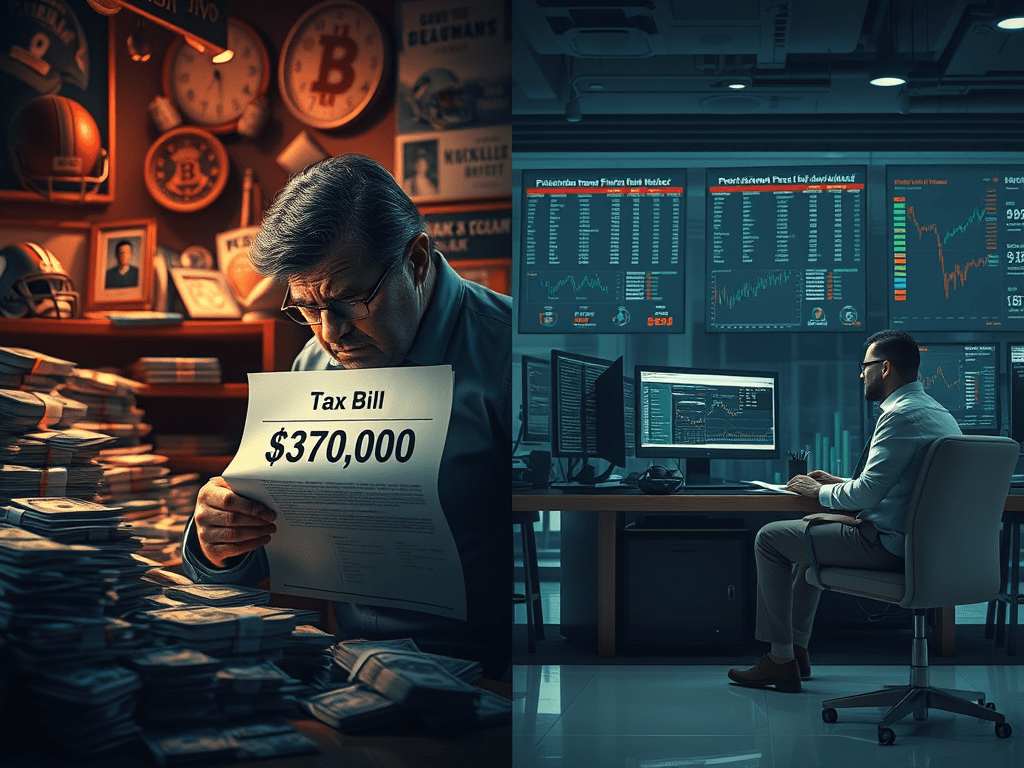

Example of the VIP Impact:

Consider a high-stakes bettor who wagers $10 million in a year and finishes exactly even (+$10M winnings, -$10M losses).

- Pre-OBBBA: Net income is $0. Tax bill is $0.

- Post-OBBBA: The bettor can only deduct 90% of their losses ($9M).

- The Result: They are taxed on $1 million of “Phantom Income.” At a 37% top federal bracket, this bettor owes $370,000 in taxes on a year where they didn’t actually make a cent.

For sportsbooks, this “tax on turnover” could crush the liquidity provided by VIPs, as the effective “vig” or “rake” now includes a massive federal tax penalty that exists even on losing or break-even years.

Why Prediction Markets Are Immune

While Online Sportsbooks (OSB) are regulated under state gaming laws and taxed as gambling, Prediction Markets (like Kalshi or Polymarket) often operate under a different regulatory and tax classification.

1. Regulation as Commodities

Many prediction market contracts are regulated by the CFTC as event contracts or commodity futures. Because they are not legally defined as “wagering,” they do not fall under Section 165(d) of the tax code. Instead, they may be treated as Section 1256 contracts.

2. Full Loss Deductibility

In the world of financial instruments, there is no “90% cap” on losses. Traders in prediction markets can typically offset their gains 100% with their losses.

- The Advantage: A “trader” on a prediction market who breaks even on $10M of volume still owes $0.

- The Loophole: Because Prediction Markets now offer “Sports Event Contracts” (e.g., betting on the winner of the Super Bowl via a contract), a bettor can essentially place the same “bet” but under a tax code that allows for full loss recovery.

Strategic Shift: The “Tax Arbitrage” Opportunity

This discrepancy creates a massive competitive advantage for Prediction Markets and a necessary pivot for Sportsbook operators.

For Operators: “Vertical Migration”

Traditional sportsbooks may look to launch their own “Prediction Market” arms or pivot their VIP offerings into CFTC-regulated “Event Contracts.” By reclassifying the activity from “gambling” to “trading,” they can protect their high-volume customers from the 90% cap.

For Customers: Writing Off Losses

Prediction market participants enjoy two major advantages that high-stakes sports bettors no longer have:

- Capital Loss Carryforwards: Unlike gambling losses, which must be used in the same year and cannot exceed winnings, certain prediction market losses can be used to offset other capital gains (like stocks) or carried forward to future years.

- 60/40 Rule: If the contracts qualify under Section 1256, 60% of gains are taxed at the lower long-term capital gains rate, and 40% at the short-term rate. This significantly lowers the effective tax rate compared to the “Ordinary Income” rates applied to sports betting.

Comparative Tax Summary

| Feature | Online Sportsbook (Post-2026) | Prediction Markets |

| Loss Deductibility | 90% of winnings (Capped) | 100% of gains |

| Tax Category | Ordinary Income | Capital Gains (Often 60/40) |

| Phantom Income? | Yes (Taxed on 10% of losses) | No |

| Loss Carryforward | No (Use it or lose it) | Yes (In most cases) |

The OBBBA effectively penalizes high-volume sports bettors for simply participating. One could anticipate this tax drives mass migration of “sharp” money and low margin high stakes VIP liquidity toward Prediction Markets in 2026. Operators who fail to offer a “Contract” based alternative to traditional “Wagering” may find their most profitable customers fleeing to platforms that offer 100% loss deductibility as a unique selling point to Traditional OSB.

Leave a comment